Privacy compliance software

Data privacy compliance and consent management on auto pilot.

Build customizable cookie banners, record user consent, inform visitors of their privacy rights, and manage data deletion requests with a simple, low-code solution.

Based on 112+ reviews on G2 and Shopify

"Enzuzo is completely self-serve and easy to use, and very attractively priced relative to competitors."

![]() Emily Wilkinson, Lucy Group

Emily Wilkinson, Lucy Group

Our platform

In a sea of competing solutions, Enzuzo stands out.

.png)

Pricing that scales with your business

Affordable privacy compliance solutions, even for businesses with dozens of domains and advanced needs.

Unlimited website traffic and page scans on all plans.

Unlimited domains available on capped pricing plan.

Change and cancel plans anytime.

.png)

Responsive customer support and intuitive UX

Sub 1-hour response time for all support tickets with privacy engineers on hand to manage technical questions.

Easy onboarding and migration from other tools.

Migration of consent logs and settings available.

Supports multiple CMS platforms.

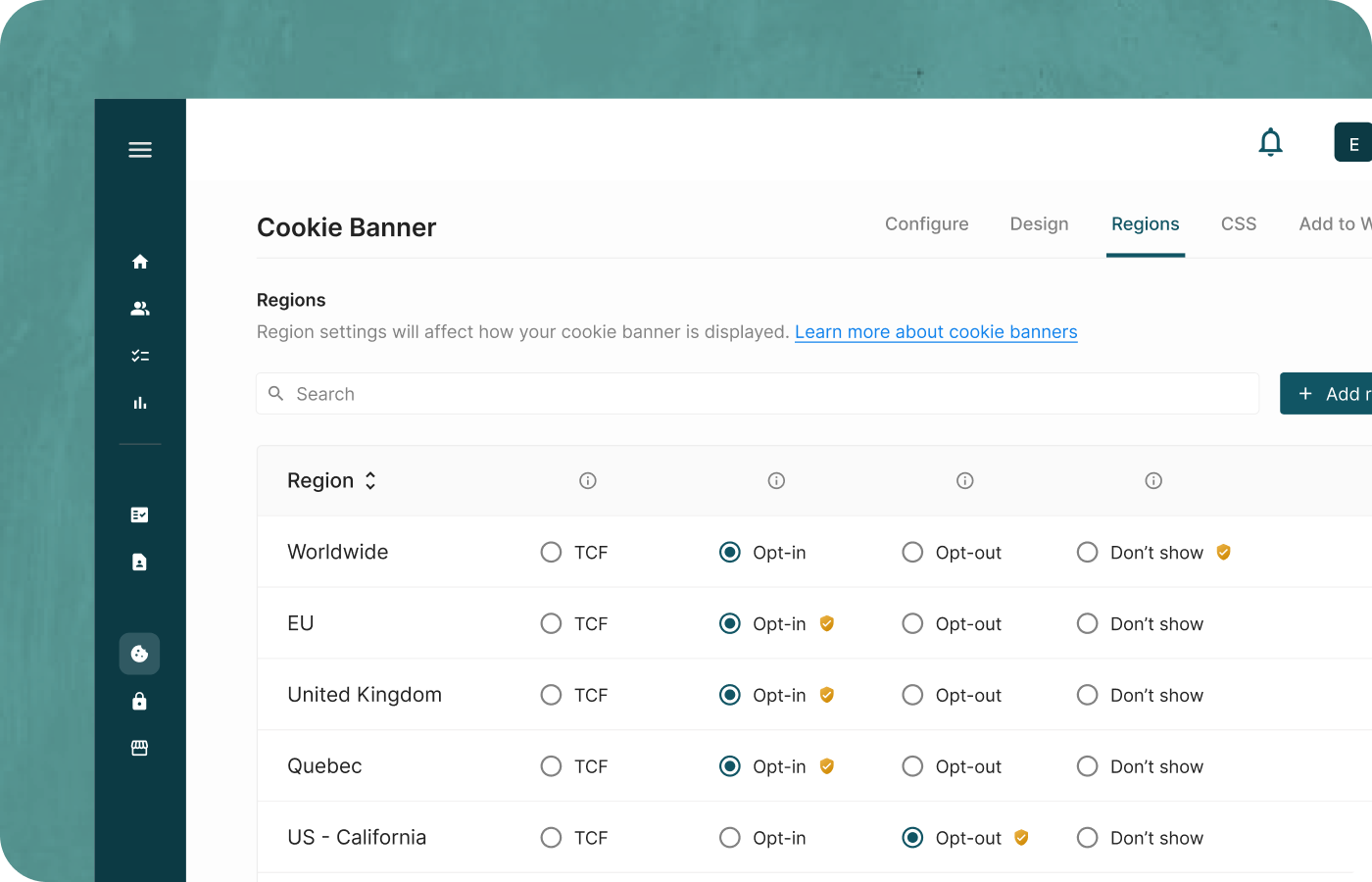

Advanced cookie consent features

Comply with GDPR, CCPA, or Quebec Law 25 with Enzuzo’s fully customizable consent manager.

Fully customizable banner in 25+ languages.

Customize consent behavior by country/state.

Scan and categorize cookies effortlessly.

Blocks cookies, I-frames, forms and objects.

View real-time consent logs and consent analytics.

Certified Google Consent Mode Partner

Enzuzo is a Google CMP-certified vendor, enabling you to comply with Consent Mode V2 with a GTM template.

Compliant with IAB Europe Transparency and Consent Framework.

Run Google Ads and Ad Sense products in the EEA.

Meet ePrivacy Directive and GDPR Requirements.

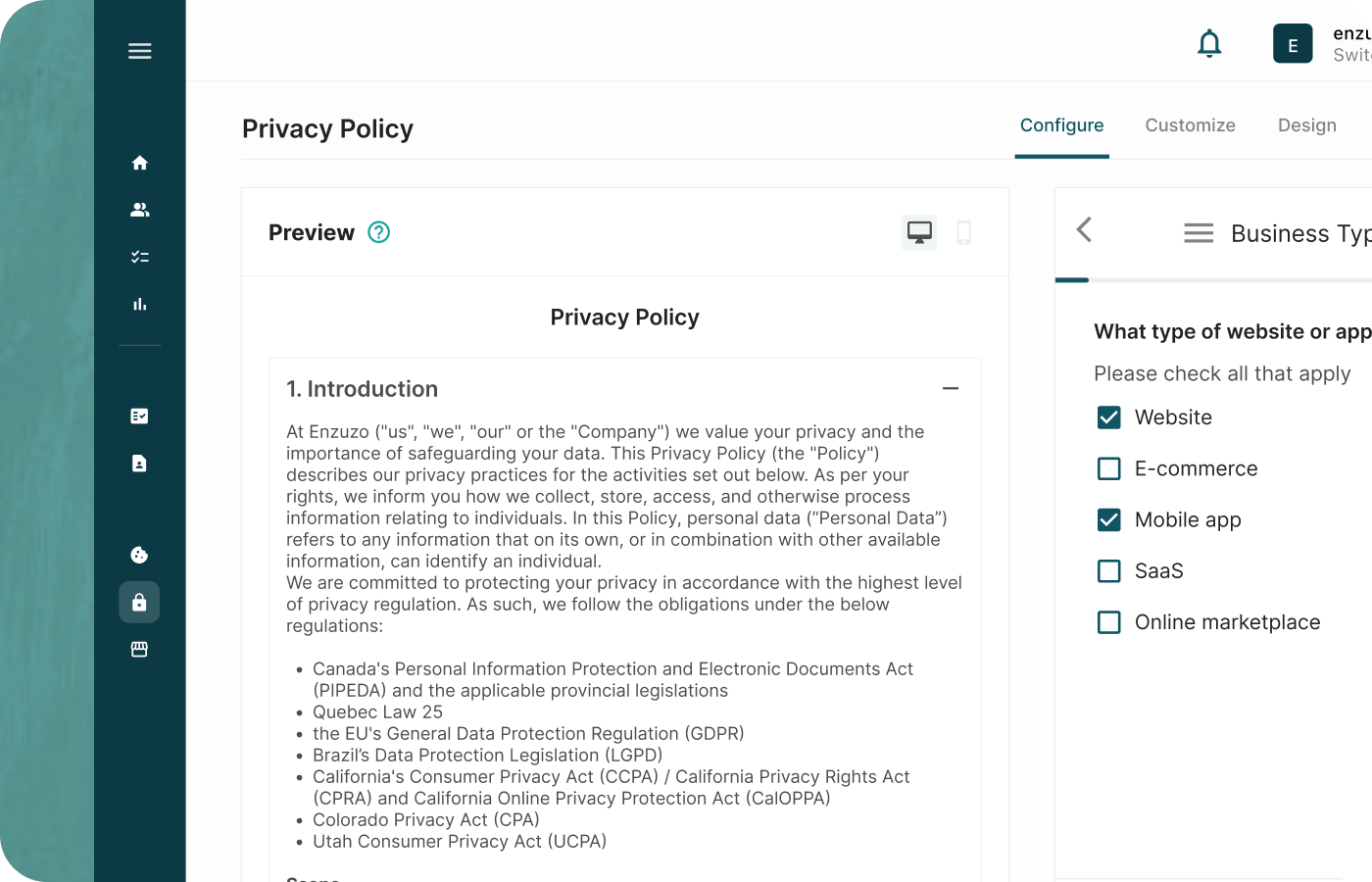

Auto-updating legal policies, built by human lawyers

Enzuzo’s core legal policies update automatically in parallel with new regulatory guidelines, saving you from compliance headaches.

Privacy policies built on feedback from expert lawyers.

Translate legal pages and cookie banners in 25+ languages to build trust and awareness.

DSAR automation to comply with GDPR & CCPA.

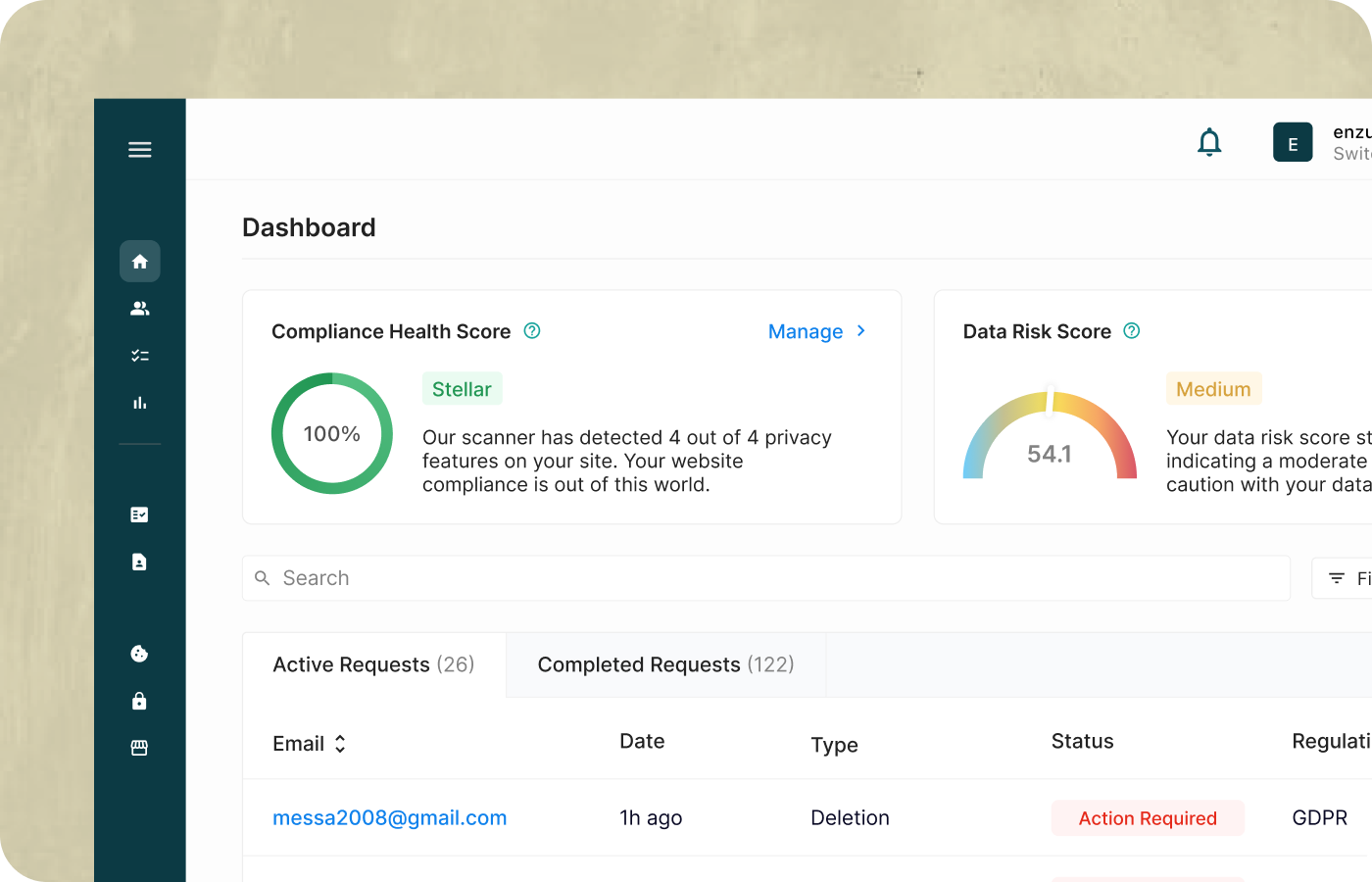

Enterprise solutions for complex needs

Enzuzo’s data privacy platform streamlines your most challenging requirements. Minimize regulatory risks, avoid fines, and free your team from non-revenue tasks.

Built-in data privacy compliance dashboards for risk assessment, data access requests, and consent management.

Data mapping and data governance workflows.

In-house team of privacy engineers and compliance experts as your privacy co-pilots.

Compliance solutions that deliver results for your business.

Agency

Add data privacy as a service to your agency's offer. Manage multiple domains and clients inside a single dashboard with custom workflows and integrations for your preferred platform. Keep your customers compliant with global regulatory requirements guided by Enzuzo.

Learn more →Enterprise

As your partner in data privacy compliance, Enzuzo demystifies global regulations to prevent privacy mishaps. Built-in dashboards, consent analytics, support for global data transfer compliance, and vendor risk management keep stakeholders informed and engaged each step of the way.

Learn more →Ecommerce

With a dedicated Shopify app and easy-to-install instructions for Wix, BigCommerce, and WooCommerce, Enzuzo helps you build privacy polices, shipping and return policies, data deletion workflows, cookie consent banners, and more to keep your store protected, compliant, and trustworthy.

Learn more →Mobile apps and Saas

Mobile App & SaaS companies need clear licensing agreements to protect intellectual property. Generate documents like an EULA or Subscription Service Agreement for SaaS for in minutes and keep your team focused on revenue generating activities.

Learn more →Privacy compliance made simple.

Enzuzo’s data privacy platform streamlines your most challenging requirements. Minimize regulatory risks, avoid fines, and free your team from non-revenue tasks.

Cookie Consent

Manage consent preferences though a customizable cookie banner and manager.

More Legal Policies.

Build terms of service agreements and shipping policies to prevent chargebacks.

Compliance Checklist

Get personalized privacy recommendations to make your website compliant.

EULA & SSA for Apps

Generate an end-user license agreement & subscription services agreement to protect your intellectual property.

“I’ve had many of my agency friends call and ask about Law 25 compliance too. Now that I have my standard operating procedures in place, it’s easy to point them in the right direction.”

![]() David Bernier, Uroboro (Webflow agency)

David Bernier, Uroboro (Webflow agency)

Join over 30,000 agencies and businesses in 50+ countries worldwide.

Thousands of forward-thinking businesses choose Enzuzo to power data privacy experiences that customers trust.

.png?width=217&height=280&name=Compliance%20Checklist%20Cover%20(7).png)

.png?width=210&height=272&name=Compliance%20Checklist%20Cover%20(5).png)